Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

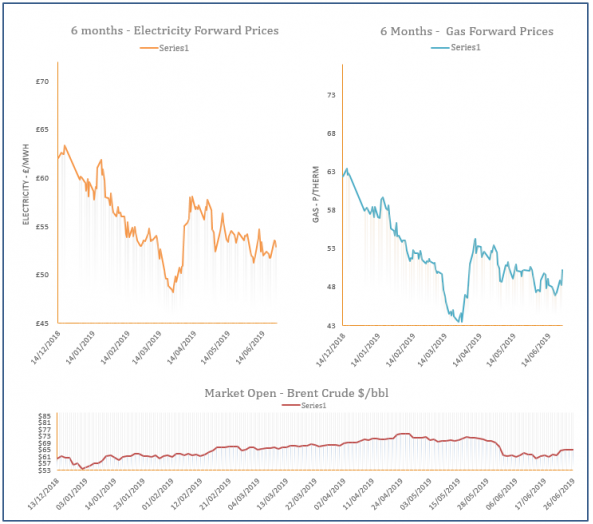

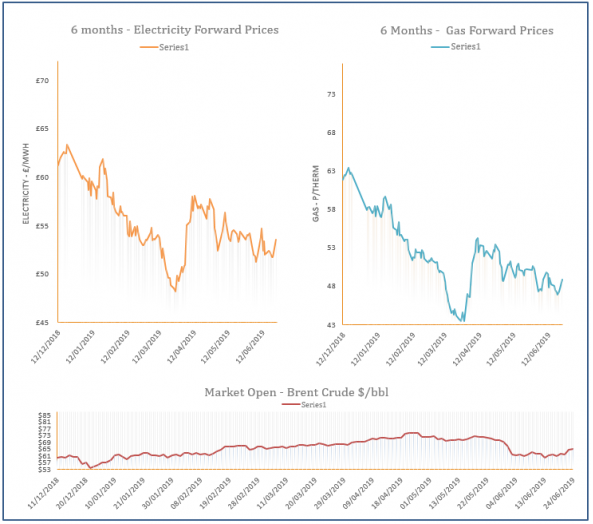

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis –26-06-2019

26th June 2019 | Posted by: Daniel Birkett | Market Analysis

A warm weather outlook and an expected rise in Norwegian & LNG flows in the coming days helped to pressure down near-curve gas prices on Tuesday. However, weak wind levels led to higher gas-fired power generation, limiting losses on the prompt, while the far-curve displayed little movement.

Energy Market Analysis –25-06-2019

25th June 2019 | Posted by: Daniel Birkett | Market Analysis

Gas prices displayed mixed movement yesterday with near-curve contracts shedding from their price and the far-curve trading higher. A sharp rise in carbon offered support to longer dated contracts, while the warm weather outlook weighed on prompt prices.

Energy Market Analysis –24-06-2019

24th June 2019 | Posted by: Daniel Birkett | Market Analysis

Gas prices opened at a discount on Friday but recovered losses as the session progressed, with upward pressure provided by a rise in coal and oil. The system was close to balance but an expected rise in LNG send-outs helped to cap gains at the front of the curve.

Energy Market Analysis –21-06-2019

21st June 2019 | Posted by: Daniel Birkett | Market Analysis

Gas prices were pushed higher by rising coal and oil markets during Thursday’s session, with the larger increases displayed towards the back of the curve. Healthy storage levels, expected LNG deliveries and milder weather capped any upward movement at the front of the curve.

Energy Market Analysis –20-06-2019

20th June 2019 | Posted by: Daniel Birkett | Market Analysis

Despite a late rally for oil prices, commodity markets were bearish on Wednesday which pressured down gas contracts. A rise in renewable availability will reduce gas-fired power demand, with warmer weather and stronger LNG send-outs also expected; weighing on the near-curve.