Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

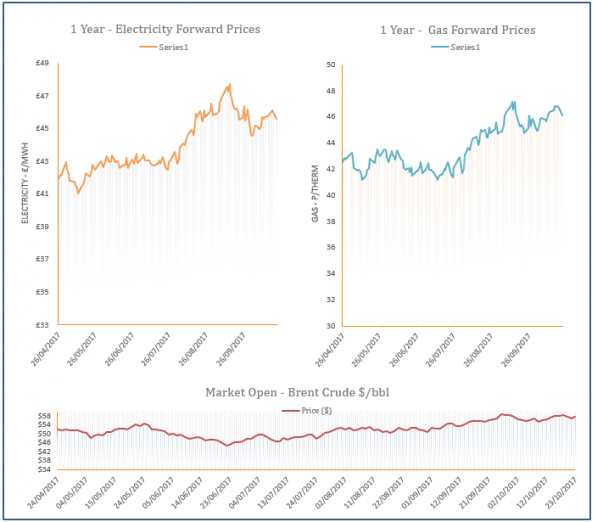

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Consultation begins to change carbon and energy reporting

24th October 2017 | Posted by: Daniel Birkett | Industry News

The Department for Business, Energy & Industrial Strategy (BEIS) has opened a consultation on Streamlined Energy & Carbon Reporting.

Energy Market Analysis - 24-10-2017

24th October 2017 | Posted by: Daniel Birkett | Market Analysis

A surge in demand levels caused by colder weather offered support to the near gas curve yesterday, with additional bullish pressure provided by an outage at the South Hook LNG terminal. Contracts further along the curve moved in the opposite direction with direction coming from weaker coal and oil prices.

Energy Market Analysis - 23-10-2017

23rd October 2017 | Posted by: Daniel Birkett | Market Analysis

Prompt gas prices moved down on Friday with high wind levels helping to reduce CCGT demand, while the LNG outlook was also comfortable with 3 deliveries expected to dock in the UK in the coming weeks. Further out, contracts were pressured down by another drop in coal prices, while Brent was stable.

ABB win Hinkley Point C order

23rd October 2017 | Posted by: Daniel Birkett | Industry News

The multinational robotics and equipment firm, ABB has won a $130m (£98.7m) order to provide the power transmission infrastructure at EDF’s Hinkley Point C.

Energy Market Analysis - 20-10-2017

20th October 2017 | Posted by: Daniel Birkett | Market Analysis

Gas prices moved down yesterday with a slight drop in demand and the scheduled arrival of 3 LNG deliveries in the UK helping to weigh on the near-curve. Further out, contracts were pressured down by further losses on coal and oil markets.