Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

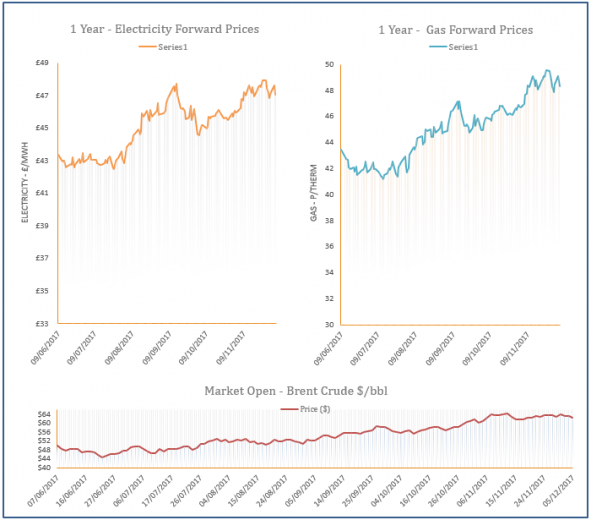

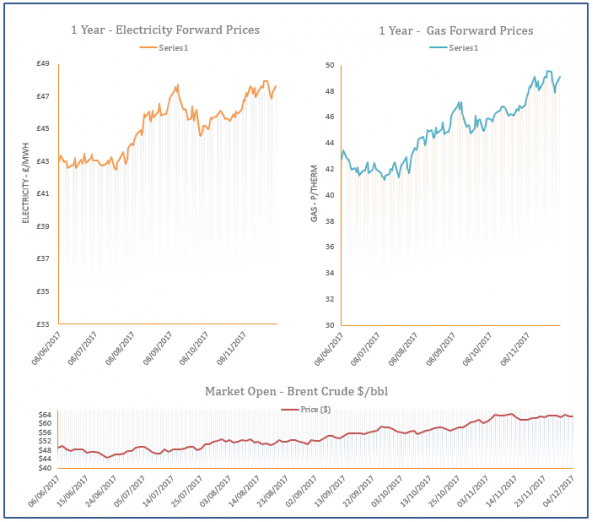

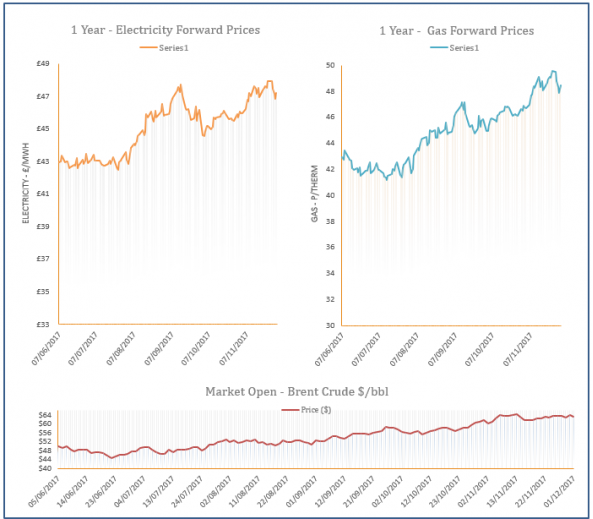

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis - 05-12-2017

5th December 2017 | Posted by: Daniel Birkett | Market Analysis

A colder weather outlook exerted bullish pressure across the near gas curve yesterday as demand levels are expected to rise. LNG supply also remained low, providing additional support at the front of the curve. Further out, a sharp drop in oil prices limited gains at the back of the curve.

Energy Market Analysis - 04-12-2017

4th December 2017 | Posted by: Daniel Birkett | Market Analysis

Gas prices increased on Friday as demand levels rose to their highest point so far this winter. Further support was provided by an expected drop in temperatures later this week, while lower storage withdrawals resulted in a short system. Oil prices also displayed a small increase which supported far-curve contracts.

Oil producers agree to extend output cuts

1st December 2017 | Posted by: Daniel Birkett | Industry News

Oil prices have strengthened following yesterday’s meeting in Vienna which saw OPEC and non-OPEC oil producing nations agree to extend output cuts until the end of 2018.

Energy Market Analysis - 01-12-2017

1st December 2017 | Posted by: Daniel Birkett | Market Analysis

A milder weather outlook for next week helped to weigh on near-curve gas contracts during Thursday’s session. However, the current cold spell helped to lift the prompt as residential demand rose to its highest level since February. Movement further along the curve was generally bearish as coal and oil markets weakened and the Pound strengthened against the Euro.