Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

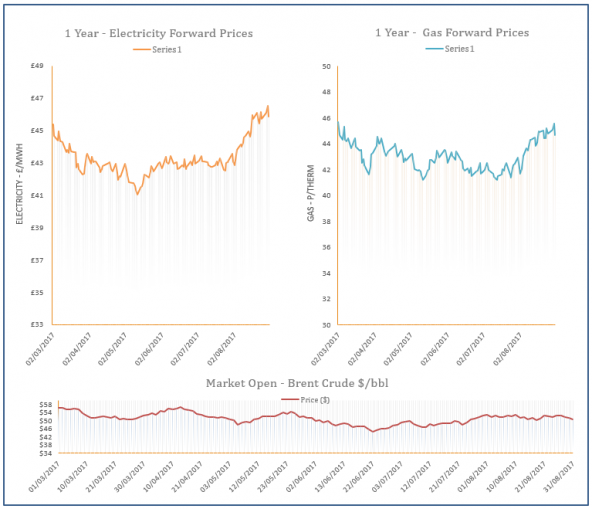

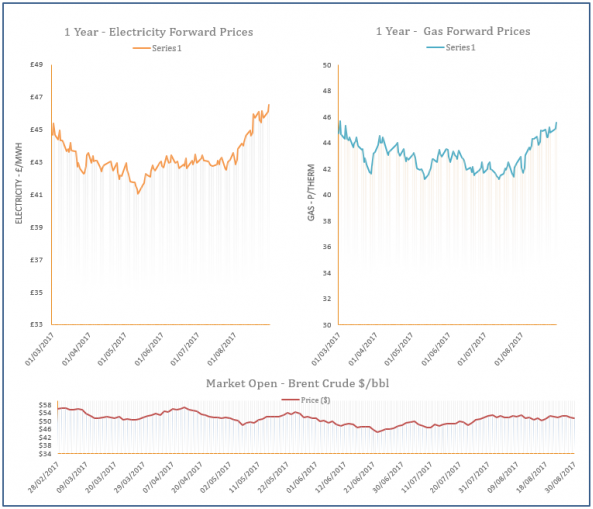

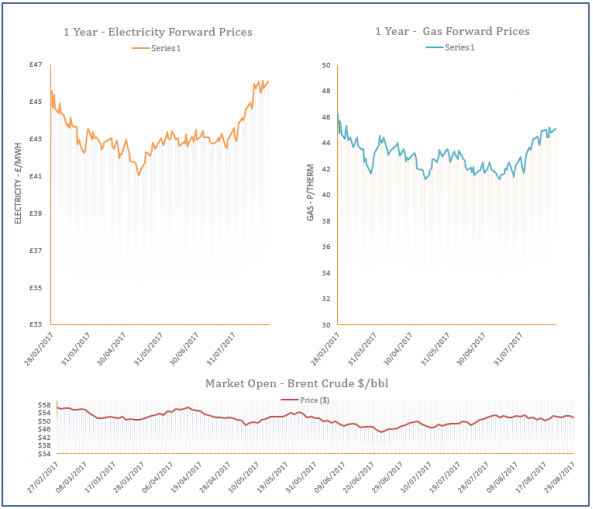

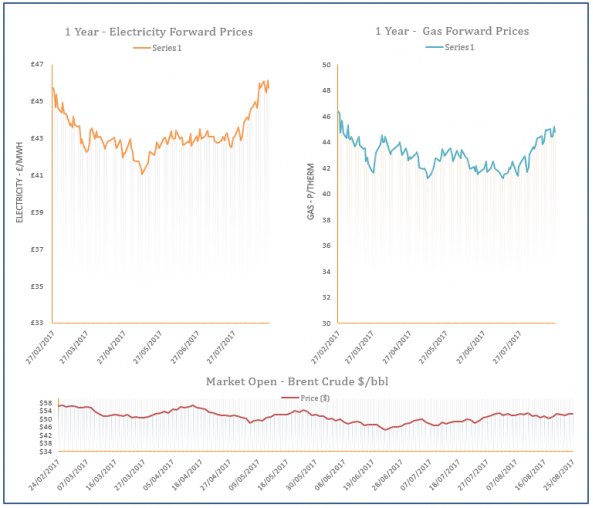

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis - 31-08-2017

31st August 2017 | Posted by: Daniel Birkett | Market Analysis

Undersupplied systems across Western Europe supported gas contracts on Wednesday, although improved UKCS production restricted gains in the UK. Maintenance at Norwegian and Russian gas fields continued to create bullish pressure, although weaker oil helped to weigh on some contracts on the far-curve.

Energy Market Analysis - 30-08-2017

30th August 2017 | Posted by: Daniel Birkett | Market Analysis

A limited wind and solar outlook helped to lift gas prices on Tuesday, with more expensive CCGT generation expected to make up the shortfall. LNG send-outs are also set to remain low in the short term and Norwegian production continued to experience issues, restricting flows into the UK and the rest of Europe.

Energy Market Analysis - 29-08-2017

29th August 2017 | Posted by: Daniel Birkett | Market Analysis

Trading was limited yesterday due to the Bank Holiday, however, warmer weather and stronger coal prices helped European markets move higher. Supply remained tight, while a weakening Pound continued to support contracts.

Energy Market Analysis - 25-08-2017

25th August 2017 | Posted by: Daniel Birkett | Market Analysis

Outages in the North Sea resulted in a balanced system yesterday, offering support to gas contracts. Flows via Langeled stood at 70mcm, however levels are expected to drop back to around the 40mcm norm next week which could result in strong undersupply. Meanwhile, the Pound continued to weaken and the outlook for oil was bullish due to the impending storm in the US.

Oil Industry braces itself ahead of Hurricane Harvey

25th August 2017 | Posted by: Daniel Birkett | Industry News

Hurricane Harvey is set to be the biggest to hit the US in almost 12 years and oil facilities across the Texan coast are being evacuated.