Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

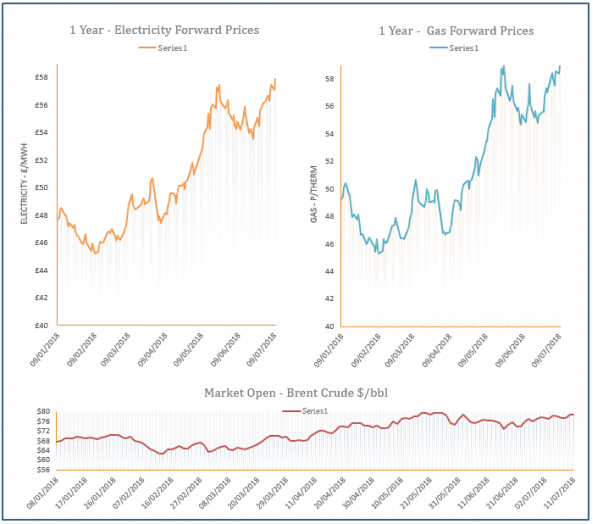

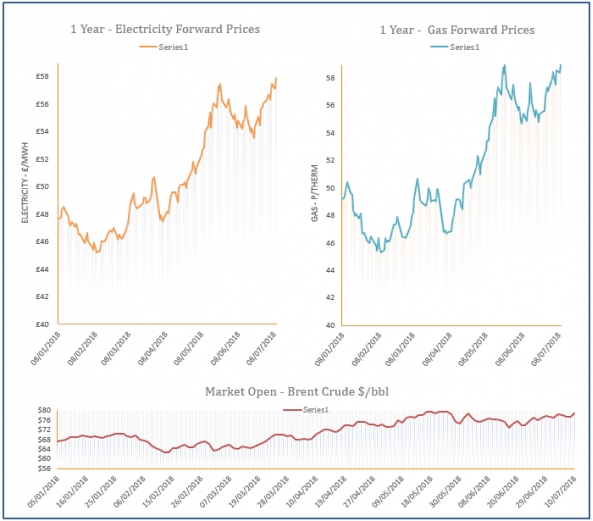

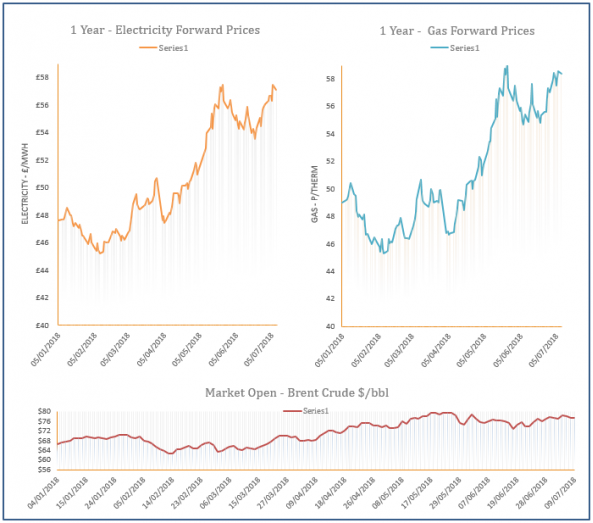

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Brent records largest loss for two years

12th July 2018 | Posted by: Daniel Birkett | Industry News

Oil prices displayed significant losses yesterday following news of a rise in supply in Libya and concerns regarding the trade dispute between the US and China.

Energy Market Analysis - 11-07-2018

11th July 2018 | Posted by: Daniel Birkett | Market Analysis

Gas prices were pushed higher by rising coal and oil markets in the morning but eased in the afternoon. Brent moved down towards the end of the session, weighing on the far-curve, while prices at the front of the curve were pressured down by an oversupplied system following a slight drop in CCGT demand.

UK to launch nuclear consultation in preparation for Brexit

11th July 2018 | Posted by: Daniel Birkett | Industry News

The government has made a number of proposals to create a new nuclear safeguard plan which would come into action when the UK leaves the EU.

Energy Market Analysis - 10-07-2018

10th July 2018 | Posted by: Daniel Birkett | Market Analysis

Increases across coal, carbon and oil markets helped to lift gas contracts yesterday afternoon, with Brent in particular rising by over $1/b due to supply issues. The Pound also weakened against the Euro, providing additional bullish pressure, while the supply/ demand picture was almost unchanged from last week.

Energy Market Analysis - 09-07-2018

9th July 2018 | Posted by: Daniel Birkett | Market Analysis

Contracts at the front of the gas curve were stable-to-bullish on Friday with annual maintenance, low LNG send-outs and higher storage injections impacting supply in the UK. Meanwhile, far-curve gas prices displayed minor losses towards the end of the session as coal and oil markets weakened.