Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

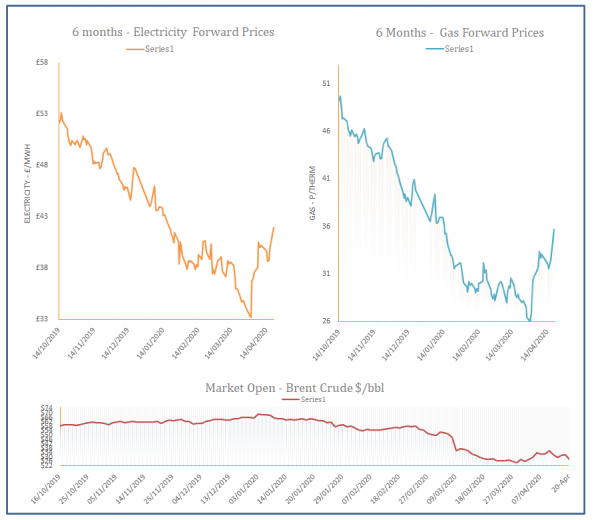

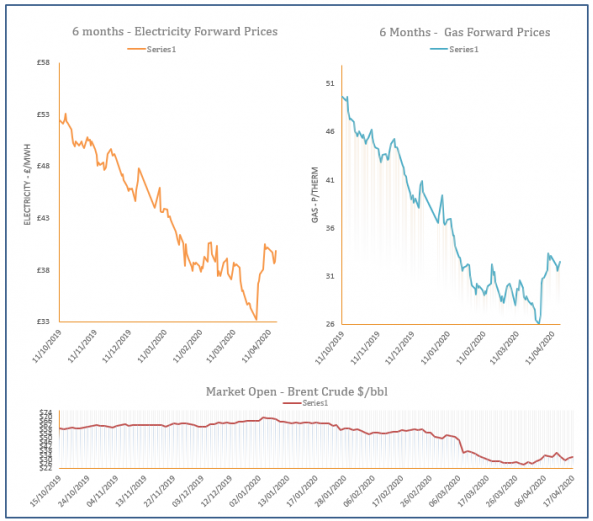

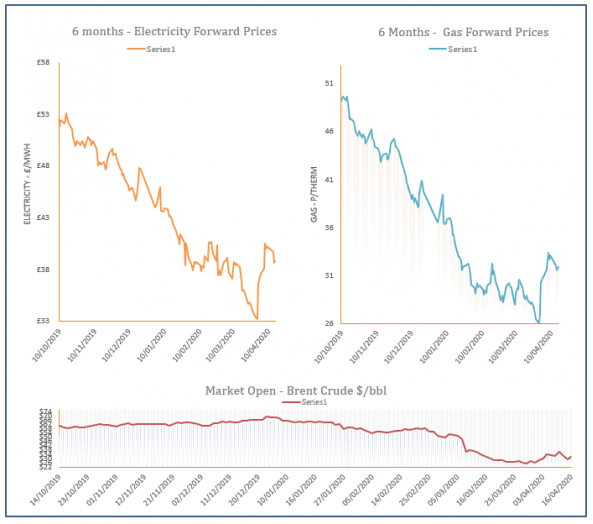

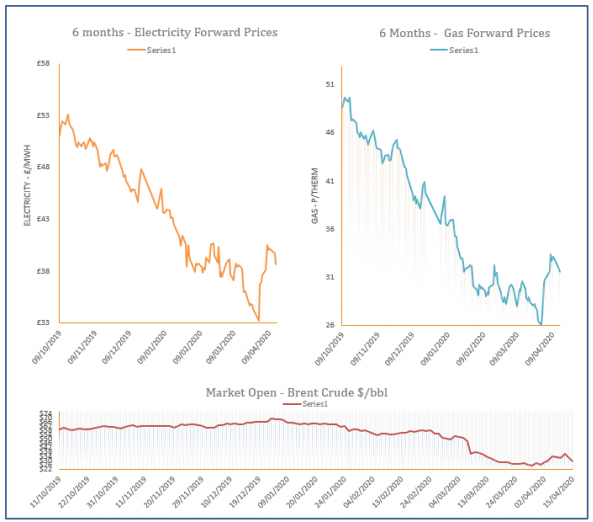

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Oil Prices fall below zero

21st April 2020 | Posted by: Daniel Birkett | Industry News

US oil prices turned negative on Monday 20th of September as oil producers had no room to store excess crude, a result of weak global demand – this resulted in a historic market collapse, significantly impacting oil traders across the world.

Energy Market Analysis - 20-04-2020

20th April 2020 | Posted by: Rebecca Haughton | Market Analysis

Supplies of Gas to the European market remain stable with Russia and Norway showing little signs of disruption, however both are delivering less than this time last year as demand remains soft.

Energy Market Analysis – 17-04-2020

17th April 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices rebounded on Thursday, with a rise in carbon offering support. A reduction in French nuclear output helped European markets move higher, as it could result in a greater reliance on coal and gas.

Energy Market Analysis – 16-04-2020

16th April 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices moved down on Wednesday, following the overall energy complex, with power & carbon markets both weakening. Commodities continue to fall due to the effects of the Coronavirus, while a warmer weather outlook should weigh on gas demand.

Energy Market Analysis – 15-04-2020

15th April 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices decreased on Tuesday, taking direction from weaker coal & oil, as any support provided by OPEC production cuts was quickly erased. Am undersupplied system limited any losses on the prompt but the short-term supply/ demand outlook is healthy.