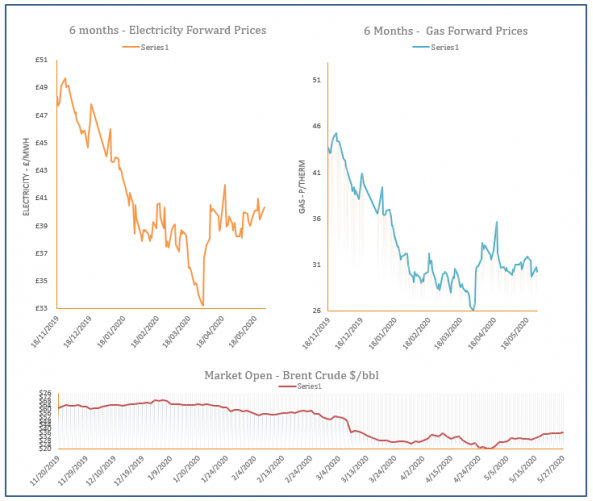

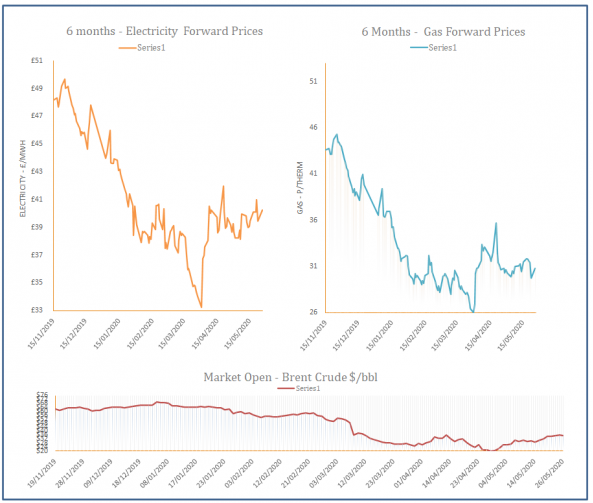

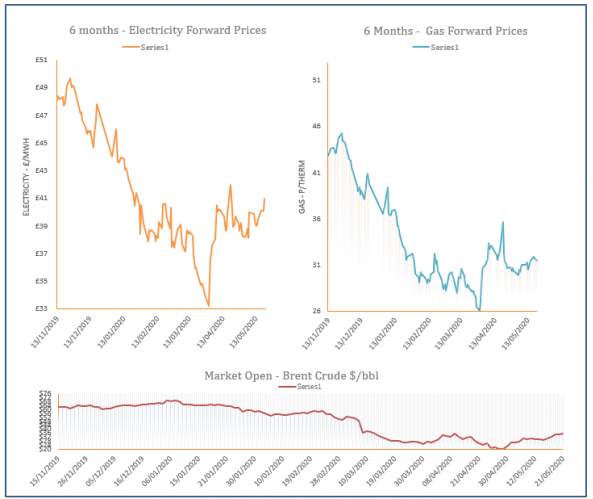

Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis – 27-05-2020

27th May 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices rebounded yesterday, catching up with global markets following the bank holiday on Monday. Stock markets and commodities all strengthened over the weekend as the easing of lockdowns has boosted economies.

Energy Market Analysis - 26-05-2020

26th May 2020 | Posted by: Rebecca Haughton | Market Analysis

Gas trading took a break yesterday for the UK bank holiday, the energy complex rose with statements form the IEA and Russia that suggest the global oil market will balance later this summer.

Energy Market Analysis – 22-05-2020

22nd May 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices displayed strong losses yesterday, with the largest decreases displayed at the front of the curve. A weak demand forecast for the bank holiday and an expected drop in gas-fired power demand contributed to the bearish sentiment.

Energy Market Analysis – 21-05-2020

21st May 2020 | Posted by: Daniel Birkett | Market Analysis

Gas was bearish during Tuesday’s trading, ignoring increases on oil, coal, power and carbon markets. Warm weather and improved flows from Norway sent the system long, resulting in losses across the near curve.

Energy Market Analysis – 20-05-2020

20th May 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices opened at a premium yesterday but corrected downwards throughout the session. A drop in oil helped to apply bearish pressure, while gas-fired power demand was also expected to increase today.