Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

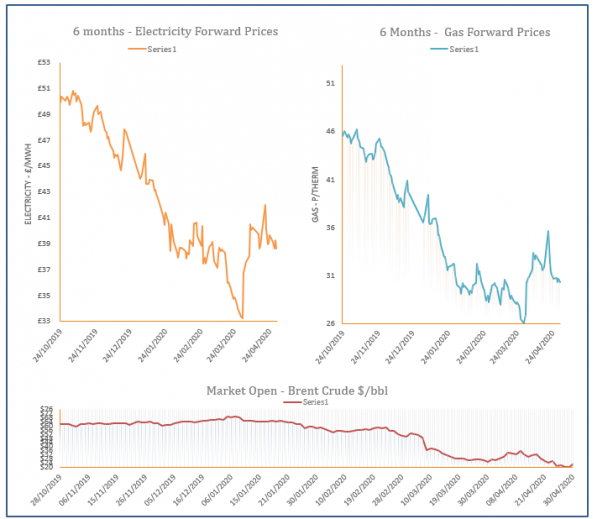

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis – 30-04-2020

30th April 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices decreased towards the end of Wednesday’s session to end the day at a discount. Prices ignored a rebound in oil and coal, although colder temperatures offered support to the prompt.

CCL rates have changed – April 2020

29th April 2020 | Posted by: Daniel Birkett | Industry News

Changes to CCL rates came into effect on the 1st of April 2020 and will appear on your next invoice.

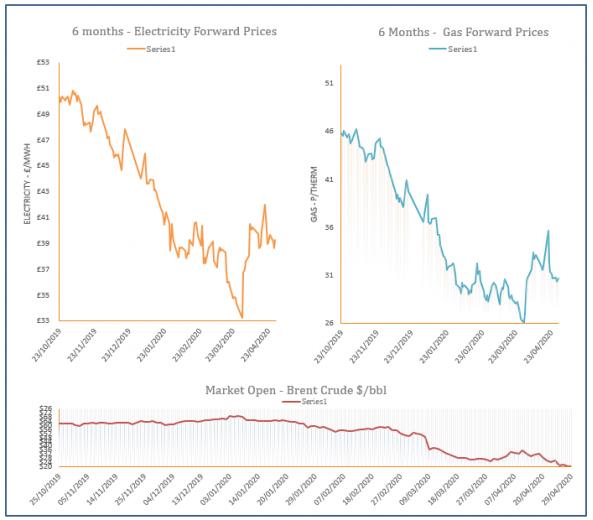

Energy Market Analysis – 29-04-2020

29th April 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices moved higher at the front of the curve as demand has increased this week, partly down to cooler weather in the UK. Longer dated contracts remained bearish, taking direction from weaker oil and coal.

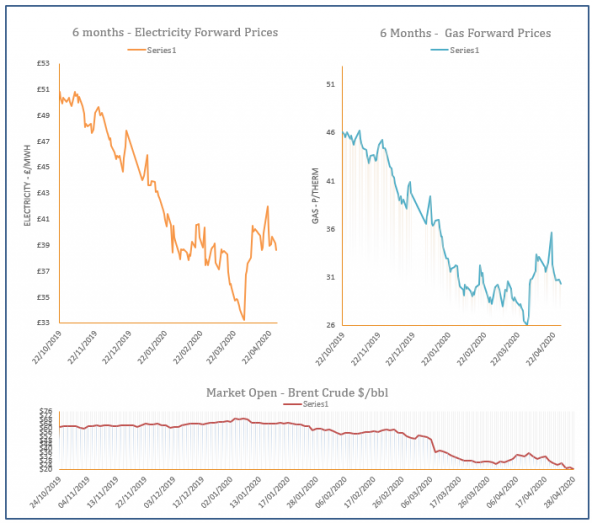

Energy Market Analysis – 28-04-2020

28th April 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices saw a mixed day of trading yesterday as the front of the curve found some support from a rise in demand, while the far curve was pressured down by a drop in oil. Some bullish sentiment was also provided by expectations of a gradual lift on lockdowns in Europe next month.

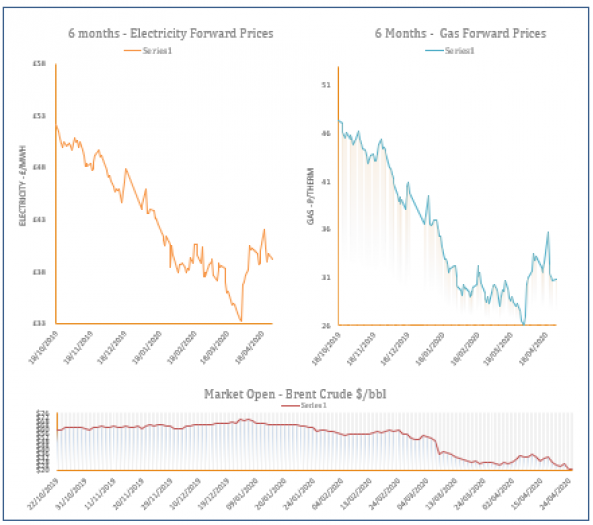

Energy Market Analysis – 27-04-2020

27th April 2020 | Posted by: Lawrence Carson | Market Analysis

UK gas contracts followed the broader markets lower, along with coal, power and carbon credits. Conventional and LNG storages in the UK and Germany are between 70-75% full as demand remains impaired due to the COVID-19 shut-ins.