Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

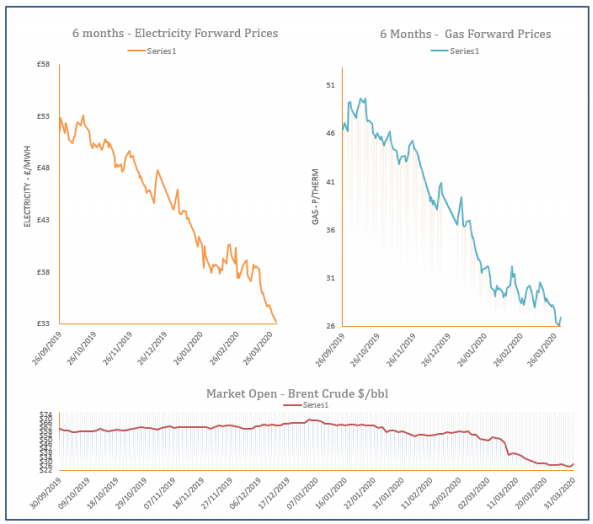

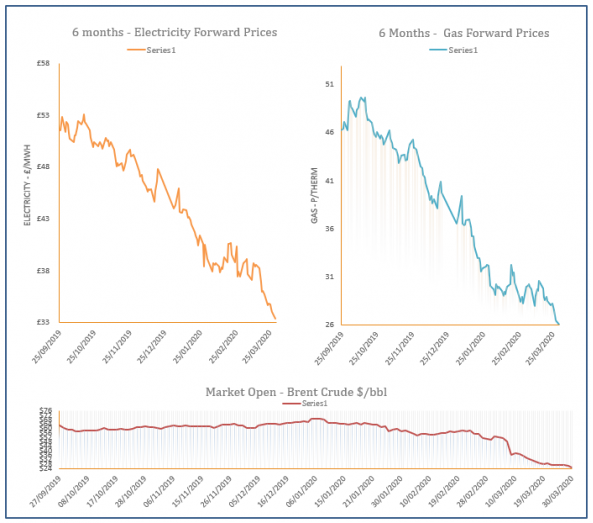

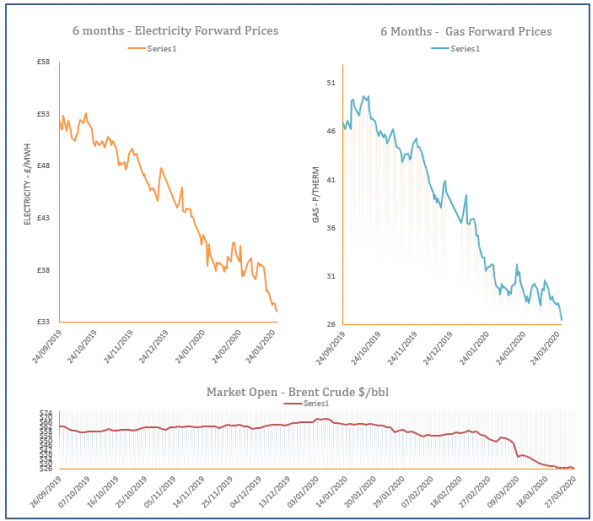

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

How has the Coronavirus impacted our climate?

1st April 2020 | Posted by: Daniel Birkett | Industry News

The spread of the Coronavirus has resulted in significant changes across the globe, including full lockdowns of countries and a ban on air travel but what impact has this had on our climate?

Energy Market Analysis – 31-03-2020

31st March 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices recorded further losses on Monday as demand levels dropped despite cooler weather, with a milder weather outlook for later in the week helping towards the bearish sentiment. The broader energy complex also remained weak, further weighing on prices.

UK Emissions fall by 41% since 1990

31st March 2020 | Posted by: Daniel Birkett | Industry News

UK emissions have decreased by 41% over the last thirty years, with the UK’s migration to cleaner energy sources a contributing factor.

Energy Market Analysis – 30-03-2020

30th March 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices capped off an overall bearish week with further losses on Friday following a global sell-off on equity markets which impacted commodities. Meanwhile, supply fundamentals also helped to weigh on the near curve, with an improved supply outlook forecast for this week.

Energy Market Analysis – 27-03-2020

27th March 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices continued to ease down during Thursday’s session, helped by a weaker demand outlook and a lack of positive indicators on global markets. Coal, carbon and oil prices all traded lower and applied additional bearish pressure to the back of the curve.