Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

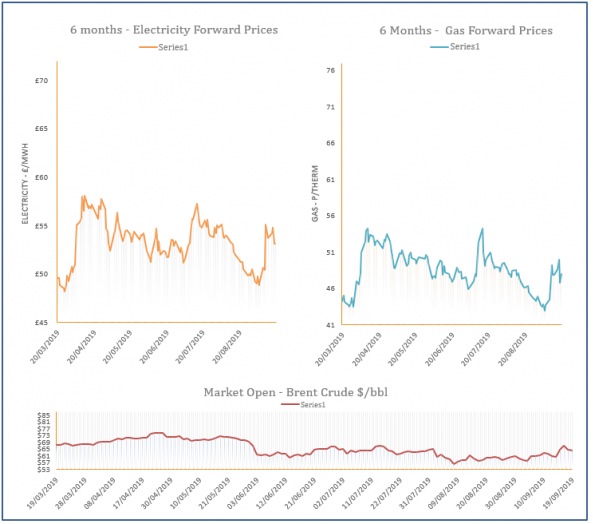

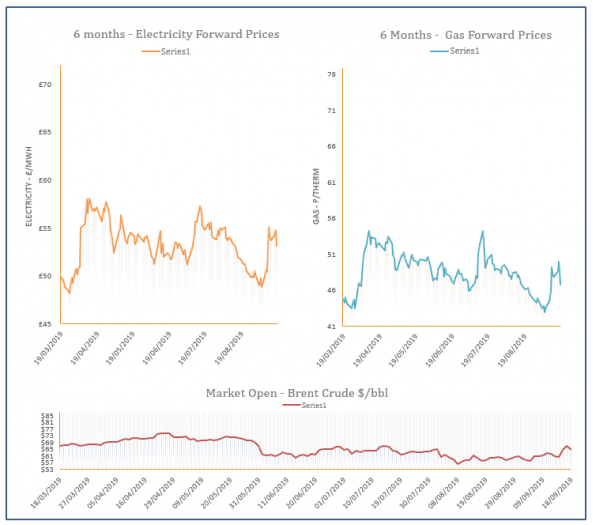

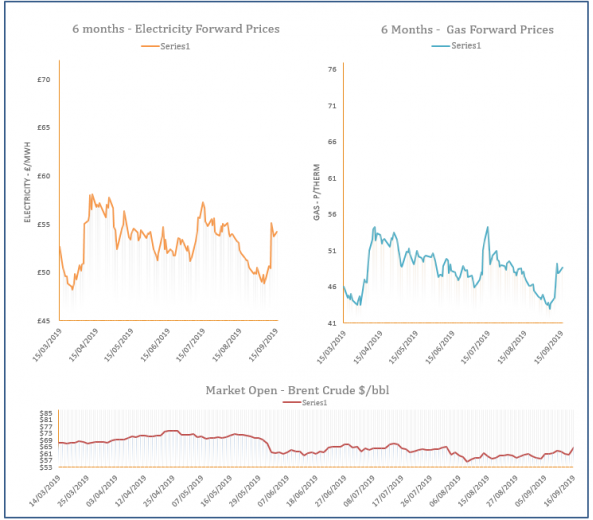

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Oil markets remain ‘well supplied’

19th September 2019 | Posted by: Daniel Birkett | Industry News

The International Energy Agency has provided reassurances that the oil market remains well supplied despite recent attacks on facilities in Saudi Arabia.

Energy Market Analysis – 19-09-2019

19th September 2019 | Posted by: Daniel Birkett | Market Analysis

Gas prices moved down yesterday as the overall energy market weakened, helped by a more optimistic outlook for oil. LNG deliveries to Europe are also set to rise, helping to weigh on the near-curve, while Norwegian flows continued to improve.

Energy Market Analysis - 18-09-2019

18th September 2019 | Posted by: Natalie Ormrod | Market Analysis

Gas contracts across the curve corrected yesterday, as Brent crude traded lower following the supply shock from the drone attacks in Saudi Arabia. Weaker coal and carbon markets also impacted on Gas prices.

Energy Market Analysis – 17-09-2019

17th September 2019 | Posted by: Daniel Birkett | Market Analysis

Gas prices climbed higher during Monday’s session, following strong gains on the oil market. An increase in coal also offered support to some gas contracts, with weak renewables also expected to result in higher gas-fired power demand, contributing to gains on the prompt.

Energy Market Analysis – 16-09-2019

16th September 2019 | Posted by: Daniel Birkett | Market Analysis

Gas prices decreased on Friday, with the exception of the Day-Ahead contract and some near-curve prices which found direction from weak renewable power availability. Bearish oil weighed on the far-curve, with a rise in coal having little impact, while carbon was stable.