Energy Market Analysis - 22-03-2018

22nd March 2018 | Posted by: Daniel Birkett | Market Analysis

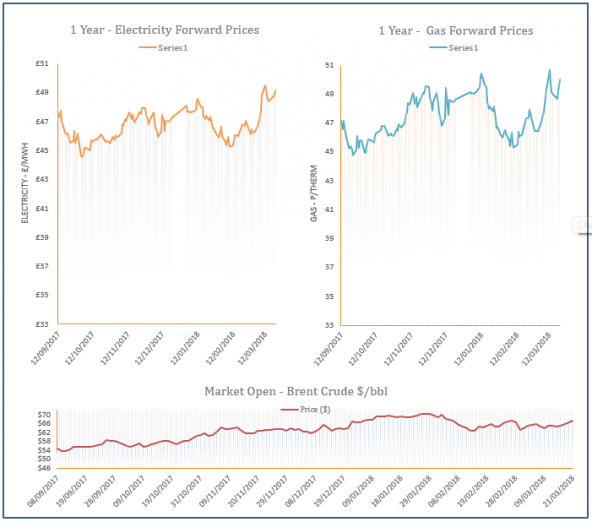

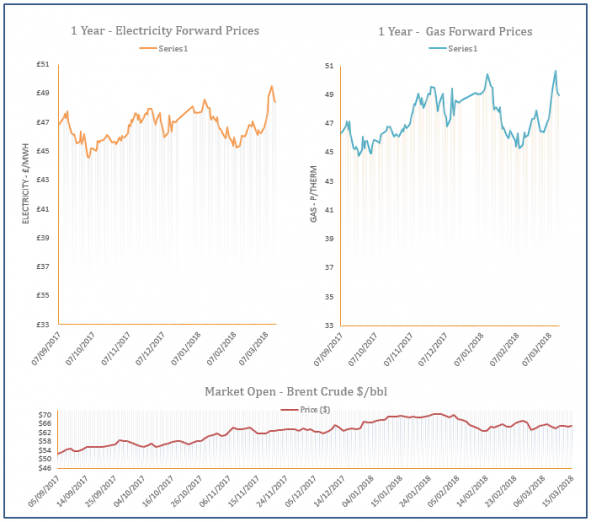

A healthier supply/ demand picture was forecast for today, helping Day-Ahead gas move down yesterday afternoon. Gains recorded in the morning were erased as the session progressed as next week’s drop in temperatures is not expected to be severe. Further out, prices were pushed higher by bullish carbon, coal and oil.

Energy Market Analysis - 21-03-2018

21st March 2018 | Posted by: Daniel Birkett | Market Analysis

Unplanned Norwegian outages restricted flows into the UK yesterday, resulting in a short system, helping gas contracts move higher. A cold outlook for the end of March and the start of April also provided upward pressure on the near-curve. Meanwhile, another rise in oil prices offered support to prices at the back of the curve.

Energy Market Analysis - 20-03-2018

20th March 2018 | Posted by: Daniel Birkett | Market Analysis

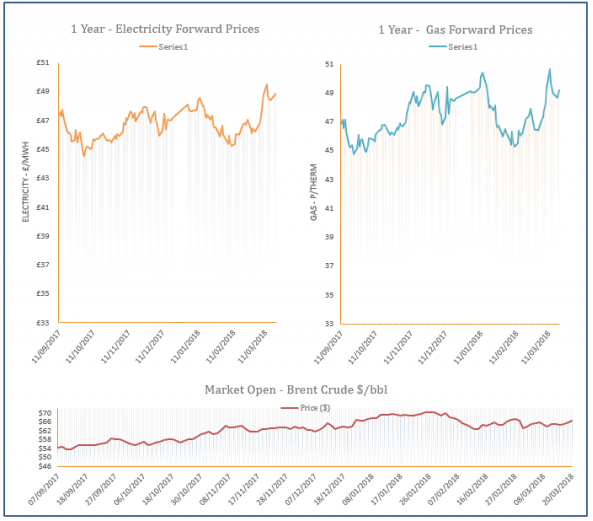

Gas prices displayed little movement during Monday’s session as temperatures are expected to turn milder later in the week which will reduce residential demand. However, any downward movement was restricted by outages at Norwegian and UKCS facilities. Further out, the Pound strengthened against the Euro and coal prices weakened, offsetting the effects of rising Brent.

Energy Market Analysis - 19-03-2018

19th March 2018 | Market Analysis

Gas prices came off quite after opening bullishly on Friday, but ultimately traded down by the sessions close. A sell off on the prompt saw 10p/th of value stripped, with long positions and improved renewables possible catalysts.

Energy Market Analysis - 15-03-2018

15th March 2018 | Posted by: Daniel Birkett | Market Analysis

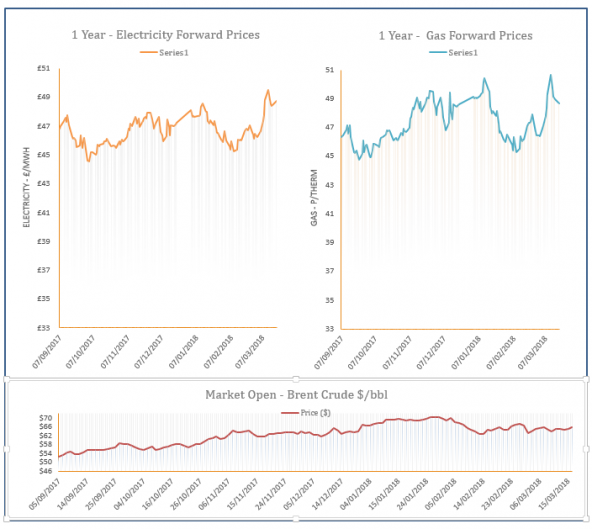

Gas prices moved down yesterday following an upward revision in temperatures for the middle of next week and the remainder of March. The system was also long throughout the session despite weak storage withdrawals and above average residential demand. Further out, a late rally in oil prices and a rebound on the coal market restricted bearish movement.