Energy Market Analysis - 21-07-2016

21st July 2016 | Posted by: Daniel Birkett | Market Analysis

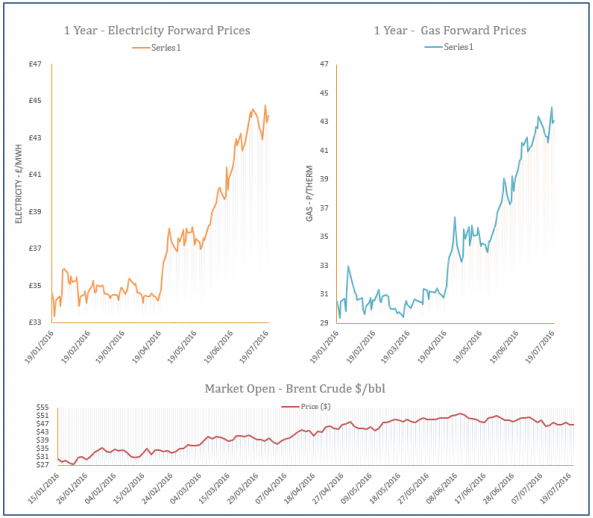

Weaker Norwegian flows and an increase in coal-fired power generation (on the back of higher cooling demand due to warm temperatures) lifted gas contracts on the near-curve yesterday. Elsewhere, there are no LNG deliveries scheduled to arrive in the UK until the 27th of July which resulted in a drop in send-outs, also offering further support to the curve.

Energy Market Analysis - 20-07-2016

20th July 2016 | Posted by: Daniel Birkett | Market Analysis

The UK gas system remained short yesterday as an increase in gas-fired power generation and higher exports to Belgium lifted demand levels. Weaker UKCS and Norwegian flows also reduced supply levels, as did a drop in LNG send-outs; this helped towards gains on the near-curve. Further out, winter contracts displayed some decreases following strong upward movement on Friday.

Market Update - Rough Storage Facility Set for Long Outage

19th July 2016 | Posted by: Daniel Birkett | Market Analysis

The offshore Rough gas field, the UK’s largest storage facility will not inject gas until spring 2017, with a high possibility that it could remain offline until autumn that year.

Energy Market Analysis - 19-07-2016

19th July 2016 | Posted by: Daniel Birkett | Market Analysis

Winter gas prices displayed a downward correction yesterday following Friday’s surge; last week’s increase was a result of Centrica’s announcement regarding the long-term outage at the Rough storage facility. However, contracts on the near-curve moved higher as the UK gas system fell short due to a rise in exports, weaker Norwegian flows, a drop in UKCS output and lower LNG send-outs.

Energy Market Analysis - 18-07-2016

18th July 2016 | Posted by: Daniel Birkett | Market Analysis

Winter contracts displayed a significant increase on Friday as it was announced that the Rough storage facility will remain offline until March 2017 following a lengthy inspection. Rough accounts for 70% of the UK’s storage capacity and the majority of the nation’s back-up supply will now come in the form of more expensive imports from Europe. The lack of storage injections will result in a long system with surplus supply exported to Belgium via the IUK pipeline.