Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

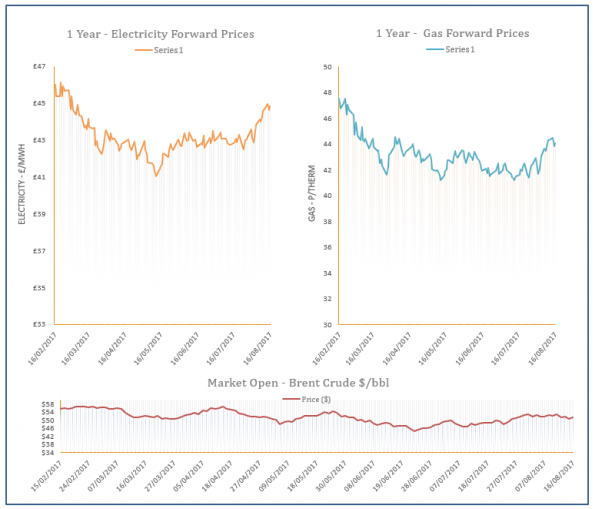

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Significant increase in outsourced energy contracts

21st August 2017 | Posted by: Daniel Birkett | Industry News

New research shows that the energy and utilities sector has outsourced £286m worth of contracts this year.

Energy Market Analysis - 18-08-2017

18th August 2017 | Posted by: Daniel Birkett | Market Analysis

Gas prices displayed mixed movement yesterday with unplanned outages providing support on the near-curve. LNG nominations were also lower, with concerns in regards to French nuclear power also a factor behind any increases. Further out, Brent was rather stable for most of the session and provided little support to gas contracts.

Energy Market Analysis - 17-08-2017

17th August 2017 | Posted by: Daniel Birkett | Market Analysis

Gas contracts added to their price on Wednesday with unplanned outages continuing to impact supply levels; maintenance at the Gullfaks field in Norway reduced flows by 6.7mcm. Weaker oil did little to restrict upward movement further along the curve as coal strengthened significantly.

Engie to invest £50m in UK hydro

17th August 2017 | Posted by: Daniel Birkett | Industry News

French electricity company, Engie are set to spend £50m on the revamp of a UK hydro power project.

Energy Market Analysis - 16-08-2017

16th August 2017 | Posted by: Daniel Birkett | Market Analysis

Gas prices moved down on Tuesday following a rise in Norwegian supply which resulted in a long system. LNG nominations at South Hook also ramped up and weaker coal & oil markets helped to pressure down contracts on the far-curve.