Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

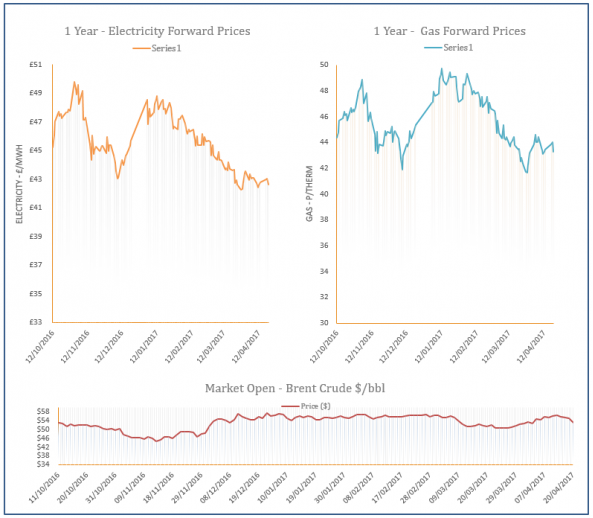

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis - 24-04-2017

24th April 2017 | Posted by: Daniel Birkett | Market Analysis

Gas prices strengthened on Friday afternoon on the back of a colder weather forecast for this week, with weaker Norwegian flows via the Langeled pipeline also a supportive factor. However, upward movement was less visible on the far-curve as weakening oil helped to weigh on contracts.

Energy Market Analysis - 21-04-2017

21st April 2017 | Posted by: Natalie Ormrod | Market Analysis

European Gas prices continued to soften yesterday as demand is expected to decrease by the end of the week due to milder weather and weaker oil prices. UK day-ahead prices traded lower as demand fell but remained high compared to seasonal norms.

Energy Market Analysis - 20-04-2017

20th April 2017 | Posted by: Daniel Birkett | Market Analysis

Weaker oil prices helped to weigh on the gas market towards the end of yesterday’s session. Contracts were stable for most of the day following early morning gains which were caused by planned production cuts at the Dutch Groningen facility. Meanwhile, temperatures were forecast to be below average for the remainder of this month, offering further support at the start of the session.

Energy Market Analysis - 19-04-2017

19th April 2017 | Posted by: Daniel Birkett | Market Analysis

Production at the Groningen gas facility will be cut by 10% in the 2017/18 gas year, falling from 24bcm to 21.6bcm; this resulted in strong upward movement on European markets. Meanwhile, the Pound weakened following Theresa May’s call for a snap election, slightly limiting gains at the front of the curve and offering support to those further out. Temperatures are also expected to remain below average for the rest of April, further contributing to the bullish sentiment.

The Snap Election will not impact the next CfD auction

19th April 2017 | Posted by: Daniel Birkett | Industry News

The government has confirmed that the snap election will not postpone the next Contracts for Difference (CfD) auction.