Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

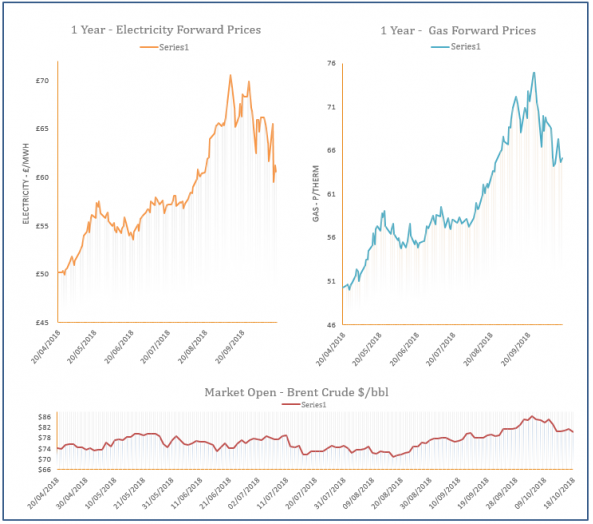

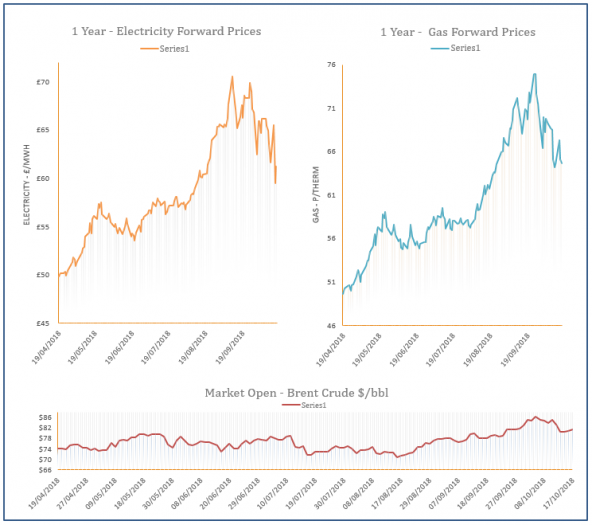

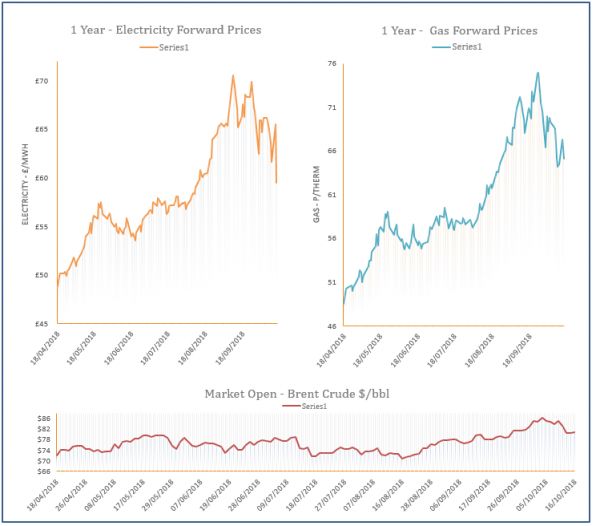

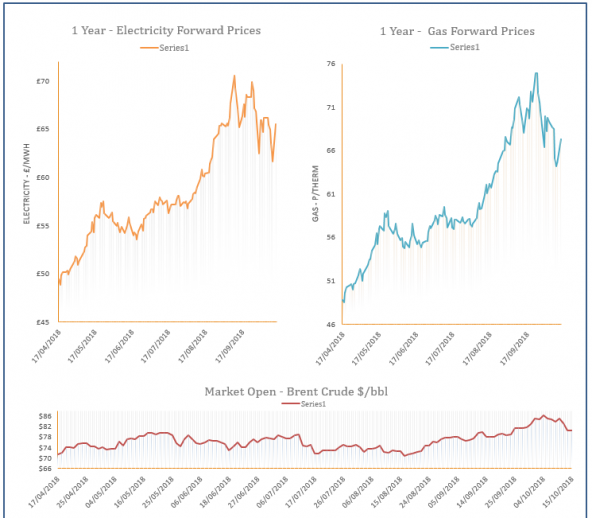

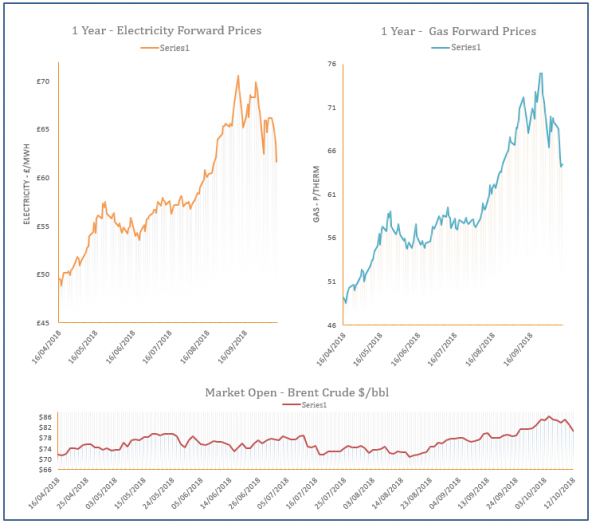

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis – 18-10-2018

18th October 2018 | Posted by: Daniel Birkett | Market Analysis

Gas prices displayed strong losses yesterday with near-curve contracts pressured down by an oversupplied system. Healthy Norwegian flows and reduced exports helped the system remain 40mcm long throughout the session. Further out, contracts found direction from a drop in oil prices following a rise in US stocks.

Energy Market Analysis – 17-10-2018

17th October 2018 | Posted by: Daniel Birkett | Market Analysis

Near-curve gas prices turned bearish yesterday as UK supply was comfortable. LNG send-outs in Europe were at their highest levels since the end of February, while the system was oversupplied due to strong Norwegian flows, improved wind levels and milder weather. Further out, a rebound on coal, oil and carbon markets restricted any losses.

Energy Market Analysis – 16-10-2018

16th October 2018 | Posted by: Daniel Birkett | Market Analysis

Movement along the gas curve was mixed yesterday with colder weather and weak wind generation lifting demand levels which resulted in gains at the front of the curve. Meanwhile, some losses were recorded at the back of the curve following a sharp decrease in EUA prices, ahead of fears that the UK could leave the EU ETS.

Energy Market Analysis – 15-10-2018

15th October 2018 | Posted by: Daniel Birkett | Market Analysis

Gas prices moved higher on Friday as temperatures for this week were revised down and an increase in storage injections is expected, tightening the system. Residential demand was forecast to rise by over 30mcm today but improved LNG flows should help to make up the difference. Further out, prices continued to take direction from rising commodity markets.

Energy Market Analysis - 12-10-2018

12th October 2018 | Posted by: Daniel Birkett | Market Analysis

Gas prices decreased on Thursday as a result of weaker demand levels and improved LNG send-outs. Demand was pushed down by a rise in wind power, while LNG send-outs at the Dutch Gate terminal reached a 6-month high. Meanwhile, falling commodity markets continued to weigh on the back of the curve.