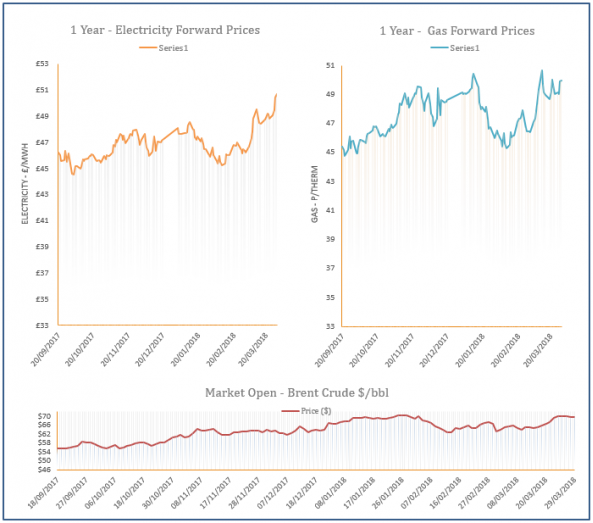

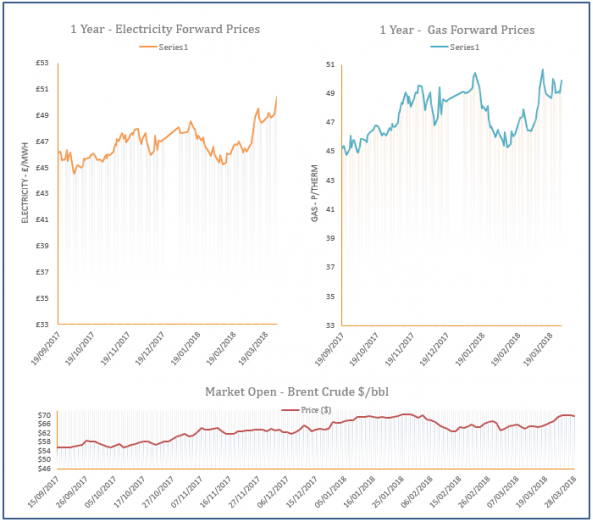

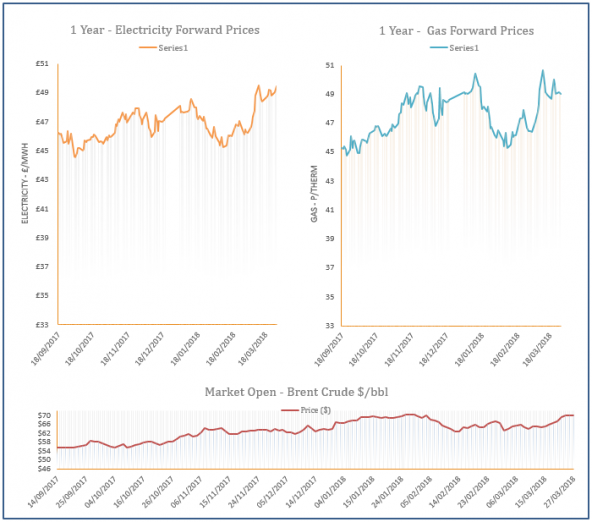

Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis - 29-03-2018

29th March 2018 | Posted by: Daniel Birkett | Market Analysis

Near-curve gas contracts moved down yesterday afternoon following a bullish opening, with a lower demand outlook expected over the Easter weekend and a rise in LNG send-outs helping towards bearish sentiment. Further out, prices found support from a likely cut in production at Groningen, as well as a strengthening coal market.

Production at Groningen to be halted by 2030

29th March 2018 | Posted by: Daniel Birkett | Industry News

The Dutch government has announced that it will cut production at the Groningen gas field to 12 billion cubic metres (bcm) per year by 2022, with extraction at the site completely halted by 2030.

Apollo Energy Upgrades Security

29th March 2018 | Posted by: Apollo Energy | Company News

To reassure our customers, Apollo Energy has acquired Cyber Essentials Certification, a government backed scheme which will protect our systems from cyber-attacks.

Energy Market Analysis - 28-03-2018

28th March 2018 | Posted by: Daniel Birkett | Market Analysis

Supply concerns pushed gas contracts higher yesterday afternoon as colder temperatures are forecast for next week, while storage levels remain low. An announcement is also expected from the Dutch government on Thursday in regards to further production cuts at the country’s largest gas facility in Groningen. Meanwhile, coal prices displayed a strong rebound due to a potential miner striker in South Africa, supporting contracts at the back of the curve.

Energy Market Analysis - 27-03-2018

27th March 2018 | Posted by: Daniel Birkett | Market Analysis

The supply/ demand outlook looks healthier for the Easter weekend as the predicted cold spell (Beast from the East 3) is now looking unlikely, with temperatures forecast to be around the seasonal norm. This helped near-curve gas contracts shed from their price, with healthy LNG send-outs also a factor. Far-curve contracts decreased in the afternoon but losses were limited by higher oil prices.