Apollo Energy publishes a daily energy market analysis, focusing on the gas, power and oil markets including a commentary on how the markets close and open. Our analysis provides insight on how the markets are performing and also considers various factors which could dictate price changes in the future.

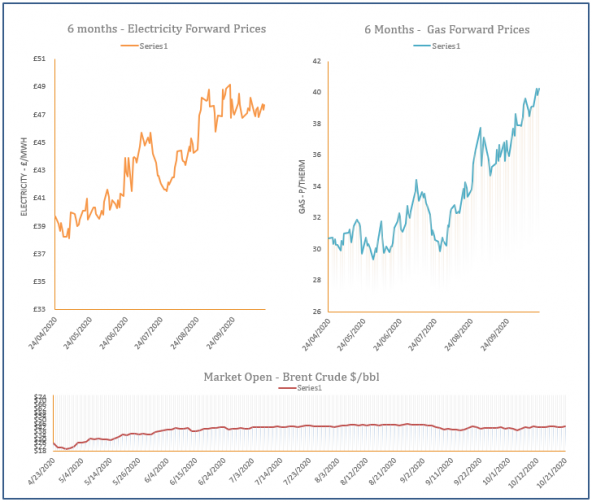

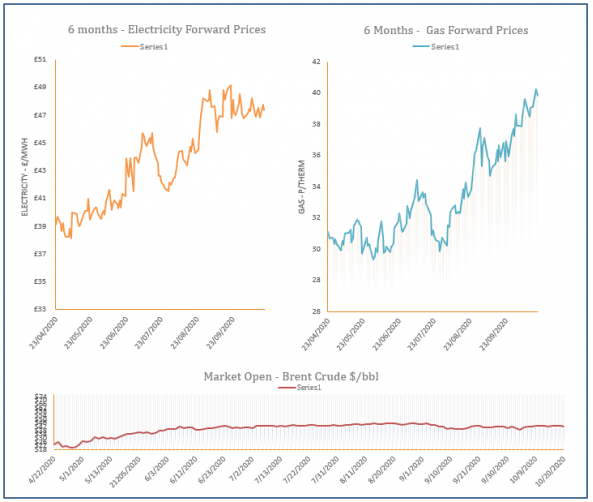

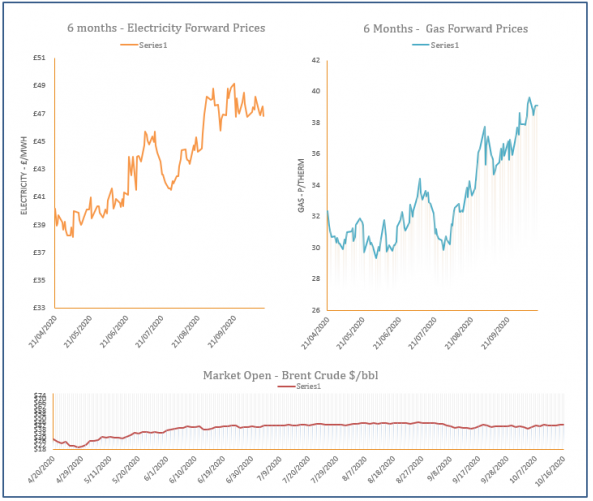

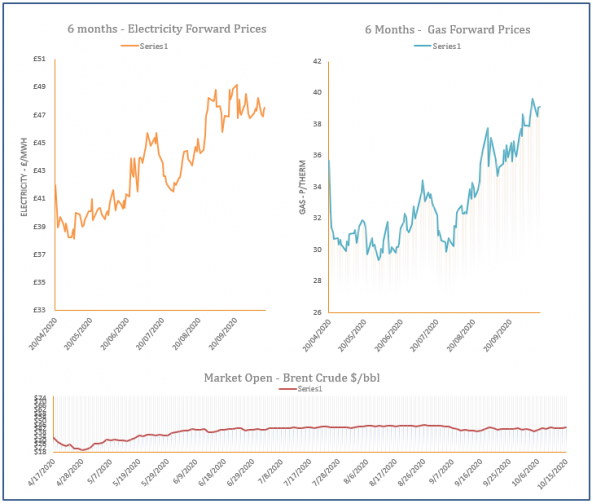

The analysis also contains a graph which tracks the one-year forward price of both gas and electricity as well as changes to Brent crude oil.

Energy Market Analysis – 21-10-2020

21st October 2020 | Posted by: Lawrence Carson | Market Analysis

European spot gas prices were mixed again yesterday as fundamentals remained almost unchanged. On the curve, prices were up on all markets, still supported by concerns on US LNG output.

Energy Market Analysis – 20-10-2020

20th October 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices found some support yesterday from a longer-term view in regard to supply/ demand but an oversupplied system helped to weigh on the prompt. Further out, commodities offered little in the way of direction and any movement was minimal.

Energy Market Analysis – 19-10-2020

19th October 2020 | Posted by: Daniel Birkett | Market Analysis

Gas prices eased down at the end of last week, taking direction from an expected rise in temperatures and renewable availability. Oil displayed a small downward correction, with volatility expected this week in the build up to the US election.

Energy Market Analysis – 16-10-2020

16th October 2020 | Posted by: Daniel Birkett | Market Analysis

Strong demand helped to lift contracts across the near gas curve yesterday, while a rise in oil markets offered support to the rest of the curve. The prompt also found support from weak renewable levels and a cold weather forecast for today and over the weekend.

Energy Market Analysis – 15-10-2020

15th October 2020 | Posted by: Daniel Birkett | Market Analysis

An expected drop in wind power and colder weather was expected to lift demand levels today, helping the prompt add to its price. The gains filtered through to the rest of the near curve, while contracts further out were pushed higher by a rise in commodities.